Applying for a loan, a mortgage, or even a mobile phone contract can be stressful—especially when you’re unsure how lenders see you. Ever been turned down for credit and left wondering why? Or maybe you’re just curious about what impacts your credit score. You’re not alone.

Understanding your credit score used to be complicated and, frankly, expensive. But platforms like ClearScore have changed that. With an easy Clear Score Login Clearscore process, you can unlock your full credit report, learn how to improve your standing, and access financial products that are right for you—all for free.

Let’s break it down so you can take full control of your credit future.

What Is ClearScore and How Does It Work?

ClearScore is a UK-based credit broker—not a lender—that provides free access to your credit score and credit report. But they go far beyond just showing you a number. Through their Credit Health feature, ClearScore helps users understand what’s influencing their score and how to improve it.

Key Features of ClearScore:

-

Free Credit Score & Report: Updated weekly without affecting your score.

-

Personalised Offers: For credit cards, loans, car finance, and more.

-

Credit Health Coaching: Articles and videos tailored to boost your credit status.

-

Identity Protection: Real-time alerts about password breaches through their Protect feature.

-

Trusted Partners: Over 90 lenders including Barclays, Halifax, and Capital One.

All of this is accessible after a quick and secure Clear Score Login Clearscore process.

Step-by-Step: Clear Score Login Clearscore Made Simple

Getting started with ClearScore is incredibly easy. Here’s how you can sign up or log in to your account:

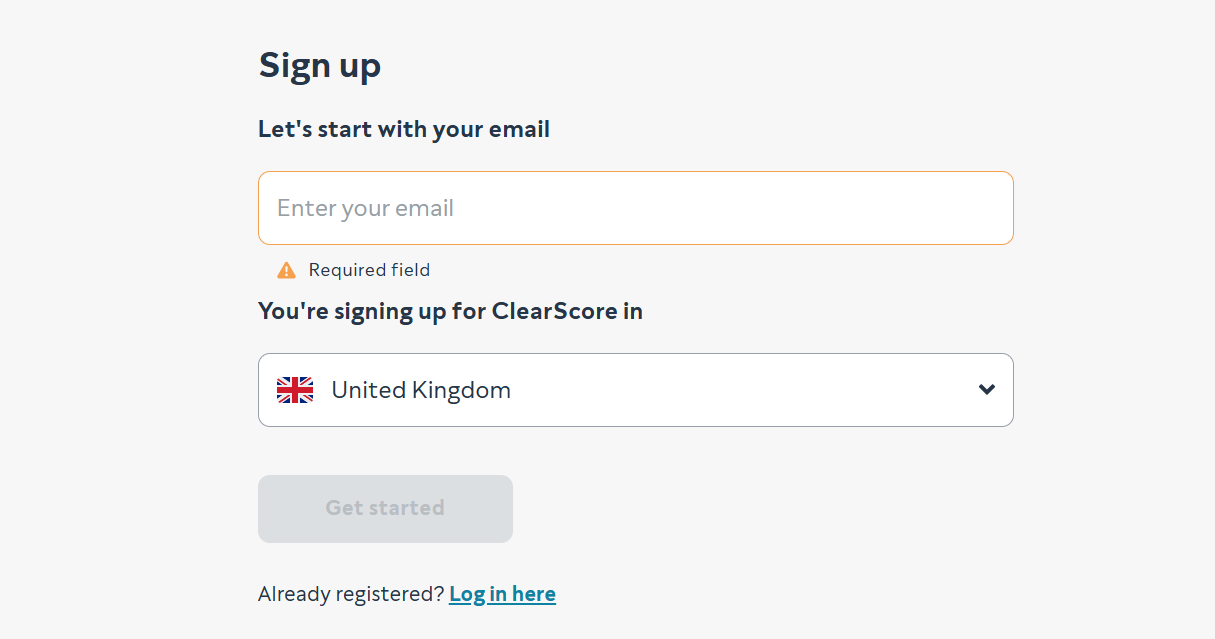

How to Sign Up:

-

Visit ClearScore’s signup page.

-

Enter your email address and country (e.g., United Kingdom).

-

Create a secure password.

-

Complete identity verification steps.

-

That’s it—you’ll instantly gain access to your credit report and score.

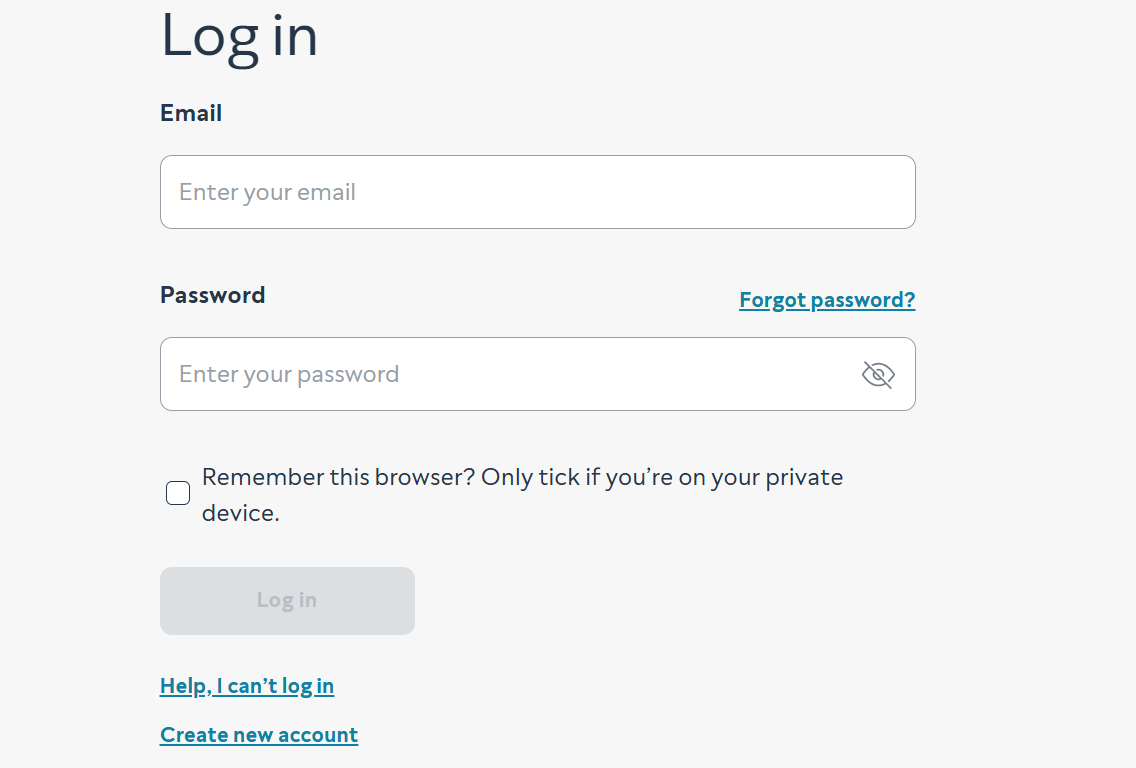

How to Log In:

-

Enter your email and password.

-

Click “Log in”. Optionally tick “Remember this browser” if on a private device.

-

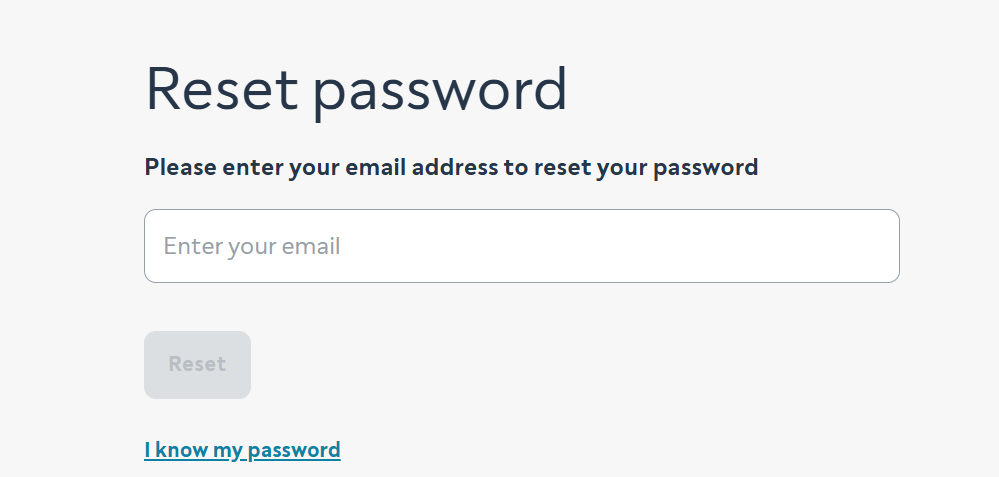

If you forget your password, simply use the reset link to recover access.

Once logged in, you can explore everything from your current credit health to offers tailored just for you.

What Is Credit Health and Why Should You Care?

Your Credit Health is more than just your score. It’s a complete view of your financial reliability from a lender’s perspective.

What It Includes:

-

Score Summary: Where you currently stand.

-

Report Breakdown: Active accounts, payment history, and hard searches.

-

Improvement Tips: Targeted advice based on your personal data.

-

Approval Insights: Your odds of getting approved for certain financial products.

It’s like having a personal financial coach right on your screen. And you can activate it through the Clear Score Login Clearscore dashboard.

Real People, Real Results

ClearScore has helped millions improve their credit confidence. Take TJ, a real user, who said:

“I recommend ClearScore to all of my friends, it’s helped boost my score to a point where applying for credit is no longer an anxious thing to do.”

That kind of peace of mind is priceless—but in ClearScore’s case, it’s completely free.

Stay Safe with ClearScore Protect

Worried about identity theft? You’re not alone. ClearScore’s Protect service scans the dark web for your email and alerts you if any of your passwords have been compromised.

Here’s what you get with Protect:

-

Immediate notifications of data breaches.

-

Insights on how to change compromised passwords.

-

Peace of mind knowing someone’s got your back.

All users get this service by default after completing the Clear Score Login Clearscore process.

Access Financial Products That Fit Your Life

ClearScore doesn’t just show you your credit standing—they help you act on it.

You Can Compare Offers For:

-

Credit Cards: Filter by benefits, APR, or approval likelihood.

-

Loans: Get pre-approved rates tailored to your profile.

-

Car Finance: Understand your eligibility without affecting your score.

All offers come with the Triple Lock Guarantee:

-

Eligibility check – see your approval chances upfront.

-

Credit score safety – no impact from viewing offers.

-

Rate transparency – know what you’ll actually pay.

Why Choose ClearScore?

With so many credit platforms out there, why is ClearScore a standout?

Recognised Excellence:

-

FinTech Company of the Year – Global Business Tech Awards

-

Best Personal Finance Company – FinTech Breakthrough Awards

-

Best Website/App – UKAB 23

Available Globally:

Whether you’re in the UK, South Africa, Canada, Australia, or New Zealand, ClearScore is making financial clarity a global movement.

Mobile Access for On-the-Go Control

ClearScore’s app is free and available on iOS and Android. Just scan the QR code on their homepage or download directly from:

Once downloaded, use the Clear Score Login Clearscore credentials you set up to access your report anytime, anywhere.

Pro Tips: Make the Most of Your ClearScore Account

-

Check Weekly: Your report updates every 7 days—set a reminder.

-

Use Credit Coach: Watch short videos and read bite-sized tips to improve your profile.

-

Apply Smart: Don’t just apply randomly. Check your approval chances before submitting applications.

-

Keep Your Info Updated: If you move or open/close accounts, update your details to keep your report accurate.

Final Thoughts

Managing your credit doesn’t have to be a mystery. With the right tools—and a quick Clear Score Login Clearscore—you can understand your credit profile, take action to improve it, and access financial opportunities that work for you.

Whether you’re rebuilding, just getting started, or looking to maximise your approval chances, ClearScore puts the power in your hands.

Start your journey today at ClearScore.com and experience the difference for yourself.