If you’ve ever applied for credit and faced an unexpected rejection, you know how frustrating it can be. For many South Africans, the root cause often lies hidden in their credit report — something most people don’t check regularly. That’s where Kudough Login Kudough comes in. It offers a simple, reliable way to access your credit report and score — for free — and take control of your financial future.

In this article, we’ll walk you through what Kudough offers, how to use the Kudough Login Kudough portal effectively, and why credit awareness is a vital part of personal financial health.

What Is Kudough and Why Should You Care?

Kudough Credit Solutions Pty Ltd, trading as Kudough, is a registered credit bureau (NCRCB29) that helps South Africans understand and improve their financial standing. It provides free access to your credit report and credit score, making it easier for you to monitor your financial health and take action when needed.

At its core, Kudough is designed around financial empowerment. Their slogan, “Know and Grow your Dough,” is more than catchy — it’s a mission to help users fix scores, reduce debt, save money, get credit, and achieve goals.

Understanding the Kudough Login Kudough Portal

To fully benefit from Kudough’s tools, you’ll need to register and log into the Kudough Login Kudough portal. Here’s a step-by-step breakdown to get started:

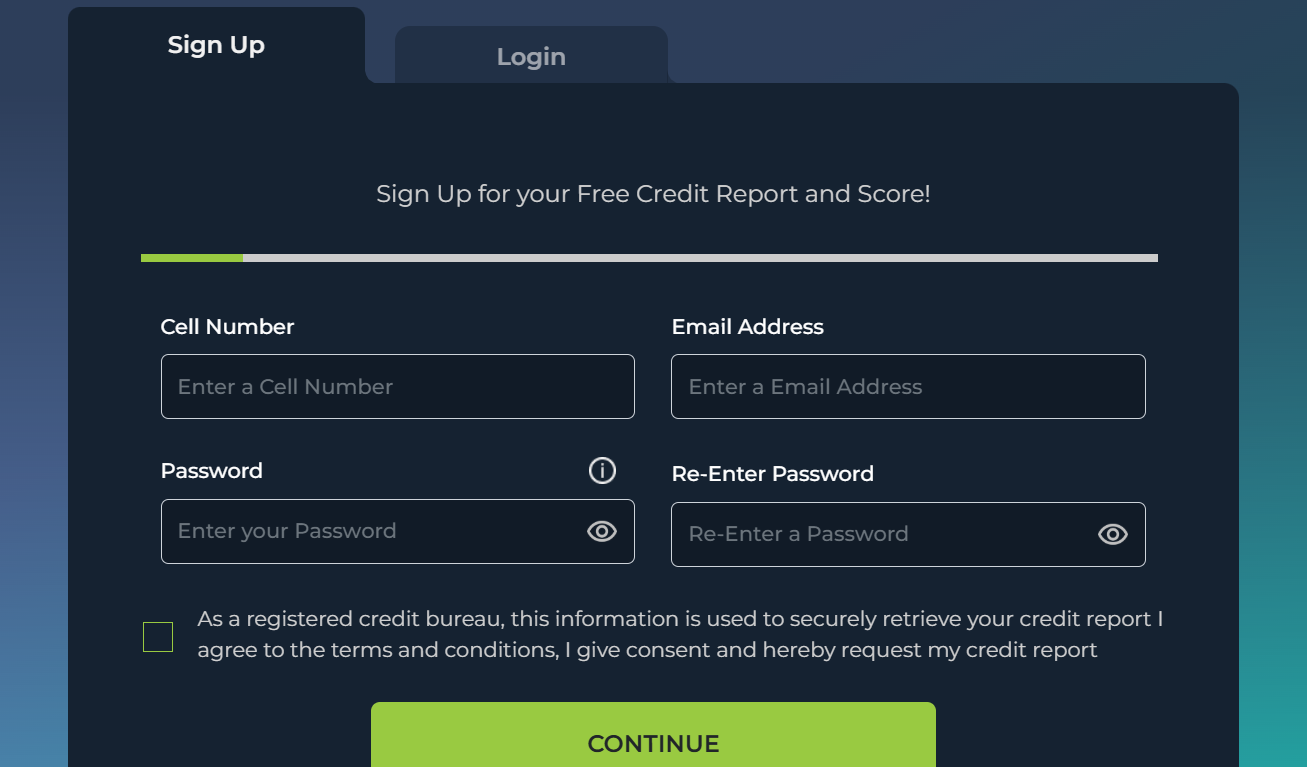

How to Sign Up:

-

Enter your cell number, email address, and password.

-

Re-enter your password to confirm.

-

Accept the terms and conditions.

-

Click “Sign Up” to create your account.

This data allows Kudough to securely retrieve your credit report.

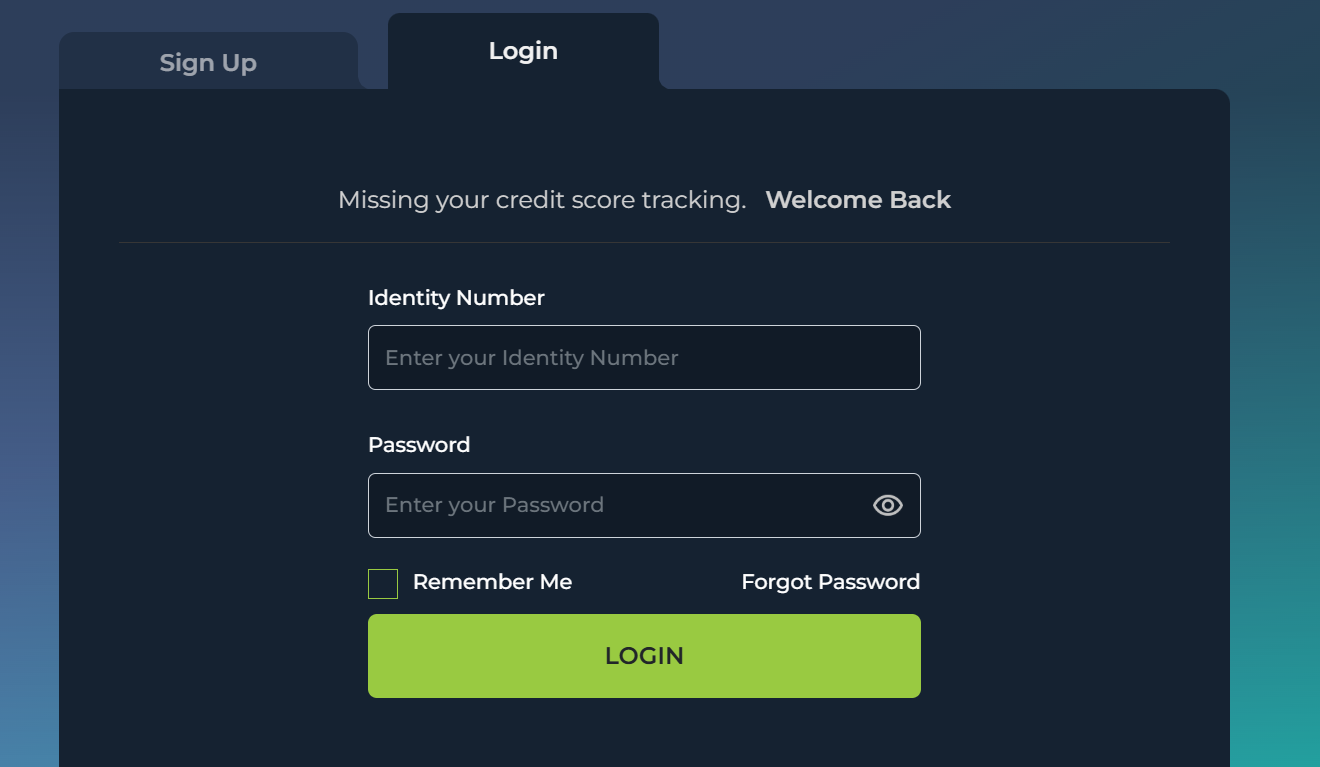

How to Log In:

-

Enter your Identity Number and password.

-

Optional: Select “Remember Me” for easier access next time.

-

Click Login.

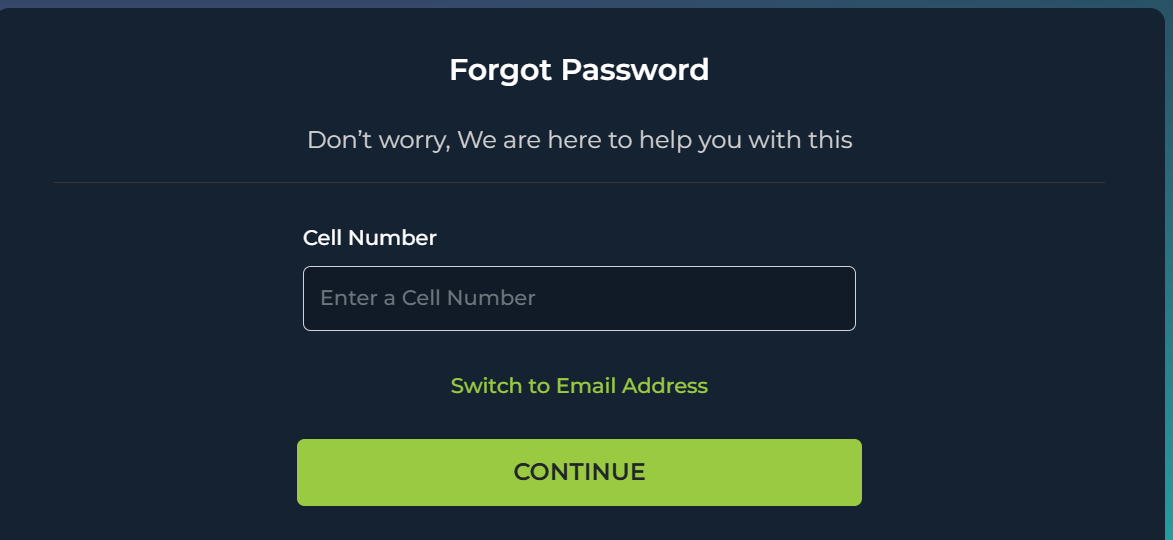

If you forget your password, visit https://clientportal.kudough.co.za/forgotpassword to reset it. You can recover access via cell number or switch to email address for verification.

What You Can Do After Kudough Login Kudough Access

Once you’re logged in, Kudough offers tools and insights to take charge of your credit profile:

✅ Free Credit Report and Score

Your credit report includes information from TransUnion, Experian, XDS, and VCCB, giving you a comprehensive overview of your credit health.

✅ Fix Credit Report Errors

Spotted an error? Kudough can help you fix incorrect entries, such as outdated defaults or duplicate listings. This is one of the fastest ways to improve your credit score.

✅ Debt Management Tools

Kudough provides personalized suggestions on how to reduce existing debt. By analyzing your report, you’ll see where to focus — whether it’s high-interest credit cards or overdue accounts.

✅ Get Better Credit Offers

When your score improves, so do your chances of being approved for lower-interest loans, vehicle finance, or even a home mortgage.

Why Credit Awareness Matters

Let’s face it — credit isn’t just for big purchases. Your credit score can impact:

-

Job applications (especially in finance roles)

-

Rental agreements

-

Mobile phone contracts

-

Insurance premiums

Kudough helps you track and understand your score without fees or hidden terms.

Tips for Making the Most of Kudough Login Kudough

Whether you’re a first-time user or checking your score regularly, here are practical ways to use Kudough effectively:

1. Check Your Report Monthly

Credit information updates regularly. Logging in at least once a month can help you stay alert to any sudden changes.

2. Look for Red Flags

Late payments, defaults, or judgments can harm your score. Addressing these quickly — with the help of Kudough — puts you on the path to recovery.

3. Set a Goal

Want to buy a car in 12 months? Use your credit report to build a realistic plan: reduce your debt-to-income ratio, improve payment behavior, and watch your score climb.

4. Use the Help Centre

Stuck? Kudough’s Help Centre and support team (info@kudough.co.za | 086 999 0952) are available to assist you with anything from login issues to report queries.

Security and Trust: Your Information Is Safe

As a registered credit bureau, Kudough follows strict compliance standards. Your identity number and login credentials are encrypted and stored securely.

Their partnerships with all four major credit bureaus — TransUnion, Experian, XDS, and VCCB — ensure that your data is both accurate and up-to-date.

Contact Information and Support

Need assistance or want to verify your account details?

📞 Call Centre: 086 999 0952

📧 Email: info@kudough.co.za

🏢 Address: Mutual Park, Jan Smuts Dr, Pinelands, Cape Town, 7450

🔗 Website: https://kudough.co.za

The Kudough team is available to help with everything from forgotten passwords to resolving credit disputes.

Conclusion: Your Financial Fitness Is in Your Hands

The journey to financial stability begins with knowledge. With Kudough Login Kudough, you gain direct access to the tools and support needed to fix credit issues, reduce debt, and open doors to better financial opportunities.

Whether you’re recovering from past financial mistakes or planning for your future, Kudough offers the clarity and control you need — completely free.