Have you ever felt frustrated managing multiple payment platforms just to handle basic transfers or receive money internationally? Whether you’re an individual or a business owner in South Africa, easy access to reliable, secure, and flexible financial tools is critical. That’s where Paydoom Login Paydoom Login South Africa steps in, offering a powerful solution for cross-border payments, multi-currency accounts, and seamless digital transactions.

This guide breaks down exactly how PayDo (commonly referred to as “Paydoom”) makes handling your finances not just easier, but smarter. Let’s dive into everything you need to know.

What is PayDo and How Does Paydoom Login Work?

PayDo is an innovative financial platform that enables users to send, receive, and store money globally in over 12 currencies. Through a simple Paydoom Login, South Africans can access features like instant account top-ups, personal and business account management, and physical and virtual VISA cards for online and offline spending.

Highlights include:

-

Free account opening and maintenance

-

Multicurrency accounts supporting EUR, GBP, USD, AUD, and more

-

Physical and virtual debit cards linked directly to your account

-

Real-time exchange rates

-

Secure funds storage in segregated accounts with top European banks

With just a Paydoom Login Paydoom Login South Africa, you unlock an extensive range of financial services tailored for flexibility and global reach.

Key Features Available Through Paydoom Login Paydoom Login South Africa

1. Multicurrency Accounts with Global Reach

One of the standout features after completing your Paydoom Login is the ability to store and transact in 12+ currencies for free. Currencies supported include:

-

US Dollar (USD)

-

Euro (EUR)

-

British Pound (GBP)

-

Swiss Franc (CHF)

-

Danish Krone (DKK)

-

Canadian Dollar (CAD)

-

Czech Koruna (CZK)

-

Romanian Leu (RON)

-

Hungarian Forint (HUF)

-

Polish Zloty (PLN)

-

Norwegian Krone (NOK)

-

Swedish Krone (SEK)

This flexibility is invaluable for individuals with global business interests or those managing cross-border transactions.

2. Issuance of Physical and Virtual Cards

Through your Paydoom Login, you can instantly order a virtual or physical VISA card. Benefits include:

-

Instant online purchases using Apple Pay and Google Pay

-

ATM withdrawals worldwide

-

No extra top-up needed—use funds directly from your PayDo balance

-

Security via 3D Secure, Face ID, or Touch ID confirmation

Cards are ready to use as soon as they’re issued, making access to your money fast and stress-free.

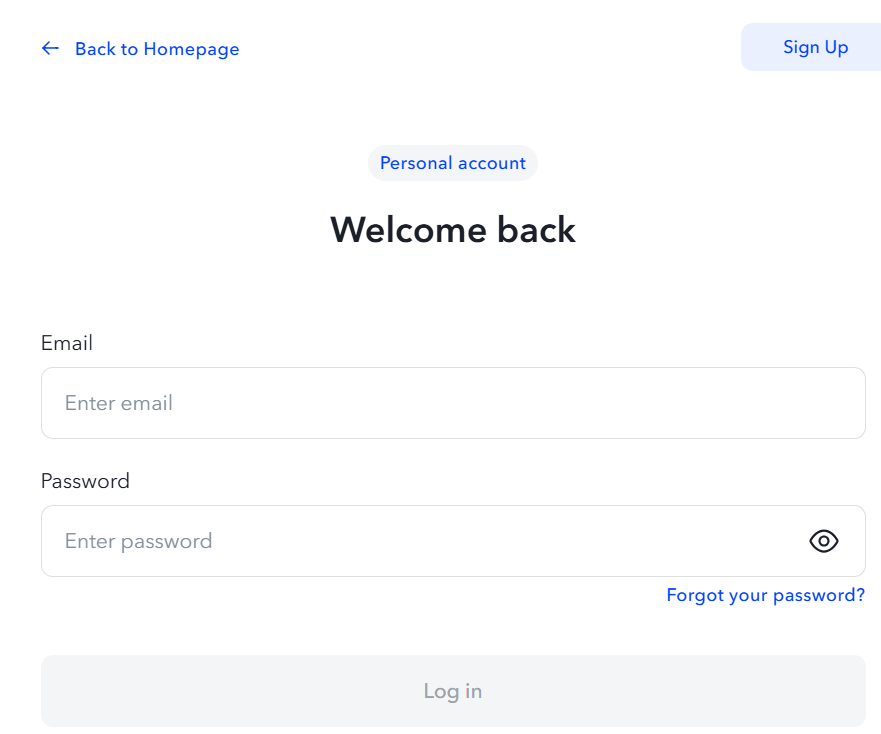

How to Get Started: Paydoom Login Paydoom Login South Africa

Creating a PayDo account is straightforward. Here’s how you can set up your personal or business account:

-

Visit the PayDo Login page.

-

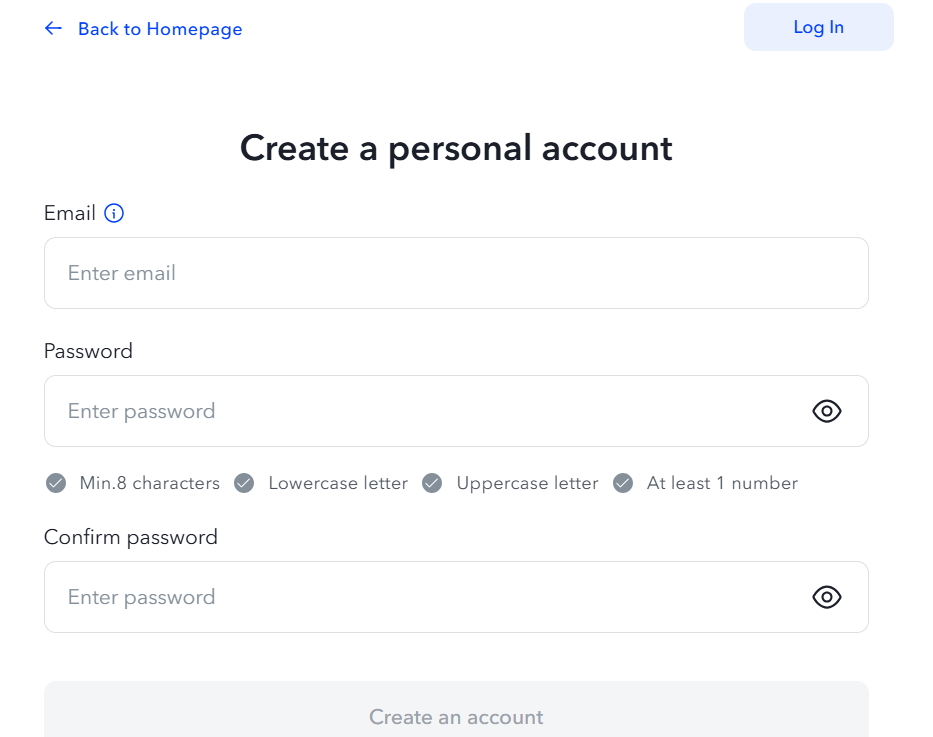

Click “Sign Up” if you don’t already have an account.

-

Fill in your email, create a secure password (minimum 8 characters with an uppercase letter, a lowercase letter, and a number).

-

Confirm your password and agree to the Terms of Use.

-

Choose between Basic and Pro verification:

-

Basic: Upload a passport, ID card, or driver’s license.

-

Pro: Upload an ID, proof of residence, and complete a short questionnaire.

-

Verification takes between 1-7 minutes depending on your selected level.

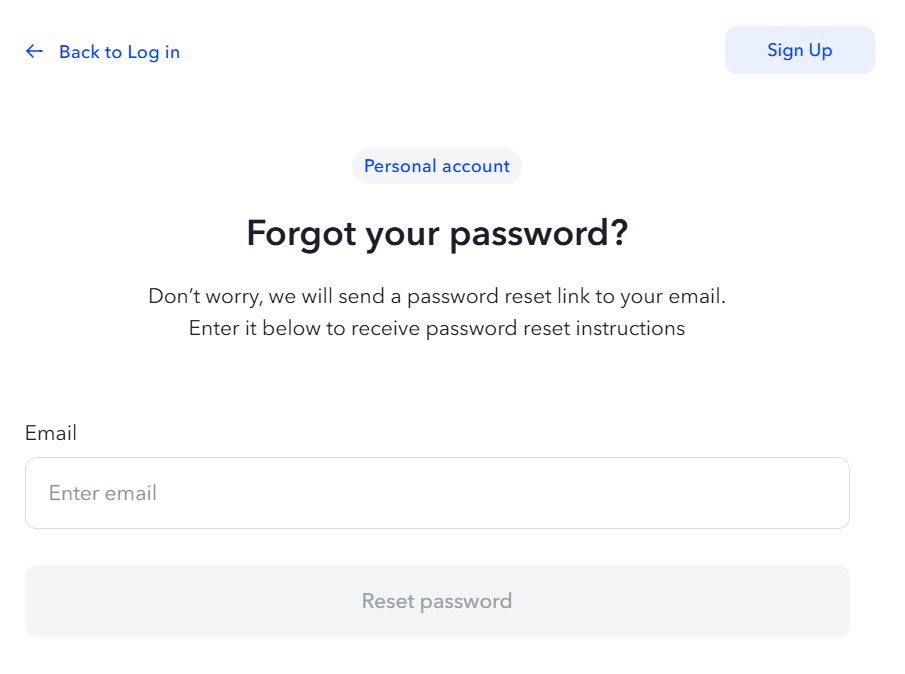

Forgot your password? No stress — simply reset it here.

Sending and Receiving Payments After Paydoom Login

Once logged in, you can:

-

Send and receive SEPA, SWIFT, and Faster Payments

-

Use your personal IBAN for local and international money transfers

-

Transfer money internally to other PayDo users completely free

-

Exchange currencies easily within your account using real-time rates

For South African users, this means efficient, low-cost international transfers without the hefty fees traditional banks often charge.

Using PayDo Cards: Shopping Made Effortless

With the PayDo card, shopping or cash withdrawal becomes simpler:

-

Use in stores and online without needing to move money to a different wallet.

-

Link it to your Apple Pay or Google Pay wallet for quick mobile purchases.

-

Enjoy real-time spending reports to keep track of your transactions easily.

You can order your PayDo card directly through your dashboard after your Paydoom Login Paydoom Login South Africa.

Why South Africans Love Using PayDo

Paydoom Login Paydoom Login South Africa offers tangible advantages:

-

Wide payment coverage in over 140 countries

-

Free internal PayDo transfers

-

Instant account top-up and checkout integration for effortless shopping

-

Safety and compliance: funds are stored in leading European banks under strict regulations

-

Custom reporting tools: Download your full payment history in .PDF or Excel formats

Plus, there are no hidden fees and no lock-in contracts—you have full control over your financial operations.

Actionable Tips to Maximize Your PayDo Experience

-

Use multicurrency balances smartly: Hold and exchange funds when rates are favorable.

-

Set up 3D Secure authentication to maximize card security.

-

Choose Pro verification if you frequently transfer large sums or receive international payments.

-

Download transaction history regularly for easy tax or accounting purposes.

Conclusion

If you’re tired of the inefficiency and hidden costs in traditional banking, then accessing financial freedom with a simple Paydoom Login Paydoom Login South Africa could be the right move. From personal spending to professional financial management, PayDo empowers users to manage their money — their way — efficiently, securely, and affordably.

Ready to experience effortless global transactions? Sign up with PayDo today and take full control of your money flow!